Benoit Wtterwulghe

Regulatory Compliance

Unlock Potential, Innovate Now, Transform Tomorrow

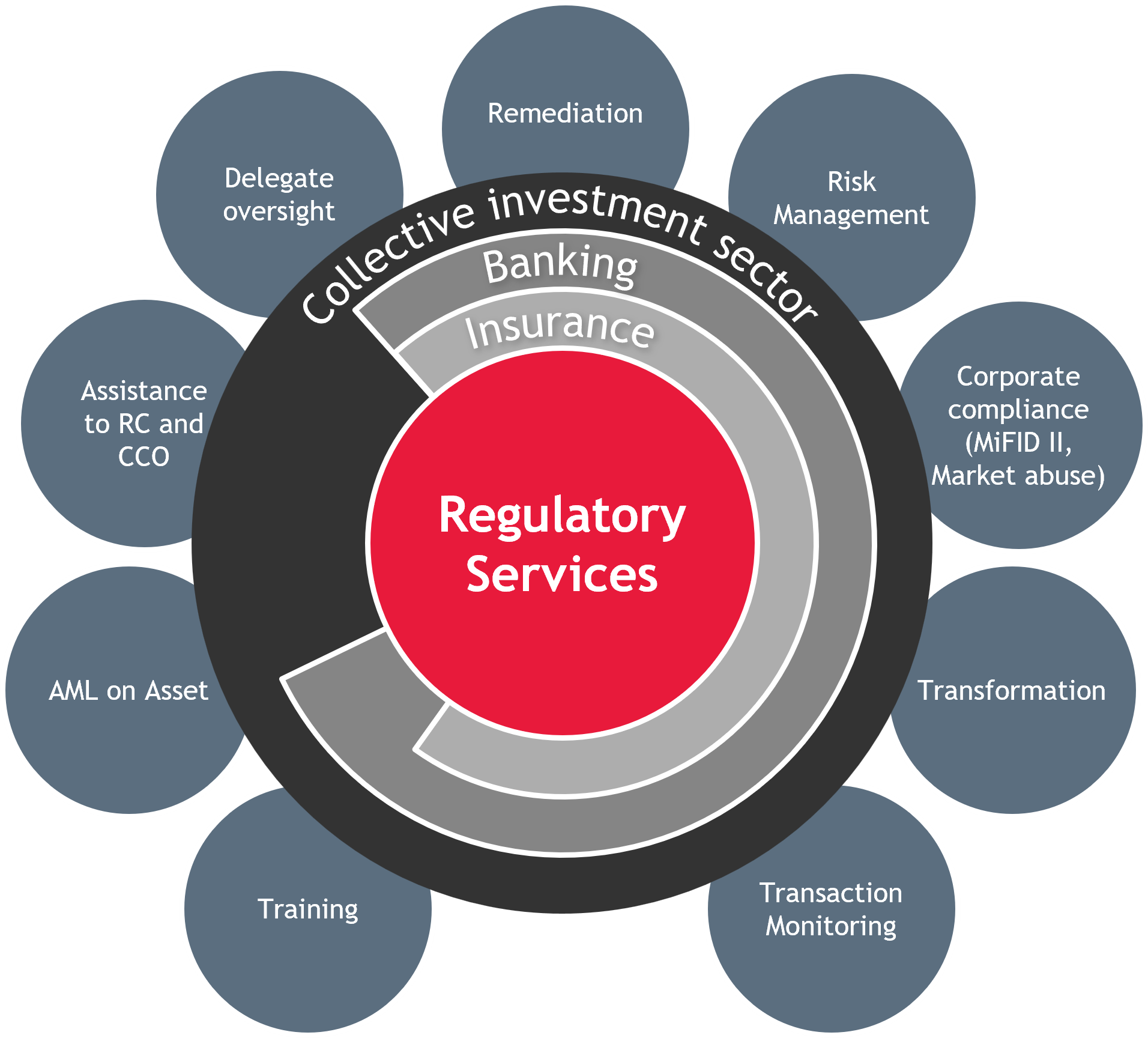

BDO experts can provide you with support tailored to your needs and your vision, to strengthen the components of your Compliance function, including prevention, detection, and remediation system, and improve controls of your Regulatory and Anti-Money Laundering and Counter Terrorism Finance risks, while considering the regulatory environment and best market practices. With this objective in mind, we can evaluate your Compliance Monitoring Plan and AML/CTF framework, and help review and update your AML policy and procedures. We can support your company in the implementation, monitoring, and execution of AML/CTF and KYC remediation plans, review outsourcing and oversight frameworks, provide assistance in the deployment and upgrade of innovative tools, assist with regulatory watch and provide detailed and efficient training as well as provide external support in case of sudden increase in AML workload.

BDO experts can provide you with support tailored to your needs and your vision, to strengthen the components of your Compliance function, including prevention, detection, and remediation system, and improve controls of your Regulatory and Anti-Money Laundering and Counter Terrorism Finance risks, while considering the regulatory environment and best market practices. With this objective in mind, we can evaluate your Compliance Monitoring Plan and AML/CTF framework, and help review and update your AML policy and procedures. We can support your company in the implementation, monitoring, and execution of AML/CTF and KYC remediation plans, review outsourcing and oversight frameworks, provide assistance in the deployment and upgrade of innovative tools, assist with regulatory watch and provide detailed and efficient training as well as provide external support in case of sudden increase in AML workload.

Our team have broad experience with many professionals from the financial sector such as banks, or asset managers, which have their own specificities, and for which we provide tailored solutions to best meet their needs.

Our AML and Compliance Advisory Services

Benoit Wtterwulghe